Modern finance

Improve employee efficiency, plan better, and reduce risk with modern solutions for corporate finance

Introducing modern finance

Finance is one of the most critical functions of any successful organization. Finance teams look at past results, current marketing indicators, and analyze trends and behaviors to identify the organization’s direction.

Since the finance team makes such important decisions, ensuring forecasts and plans leverage quality, error-free data is paramount.

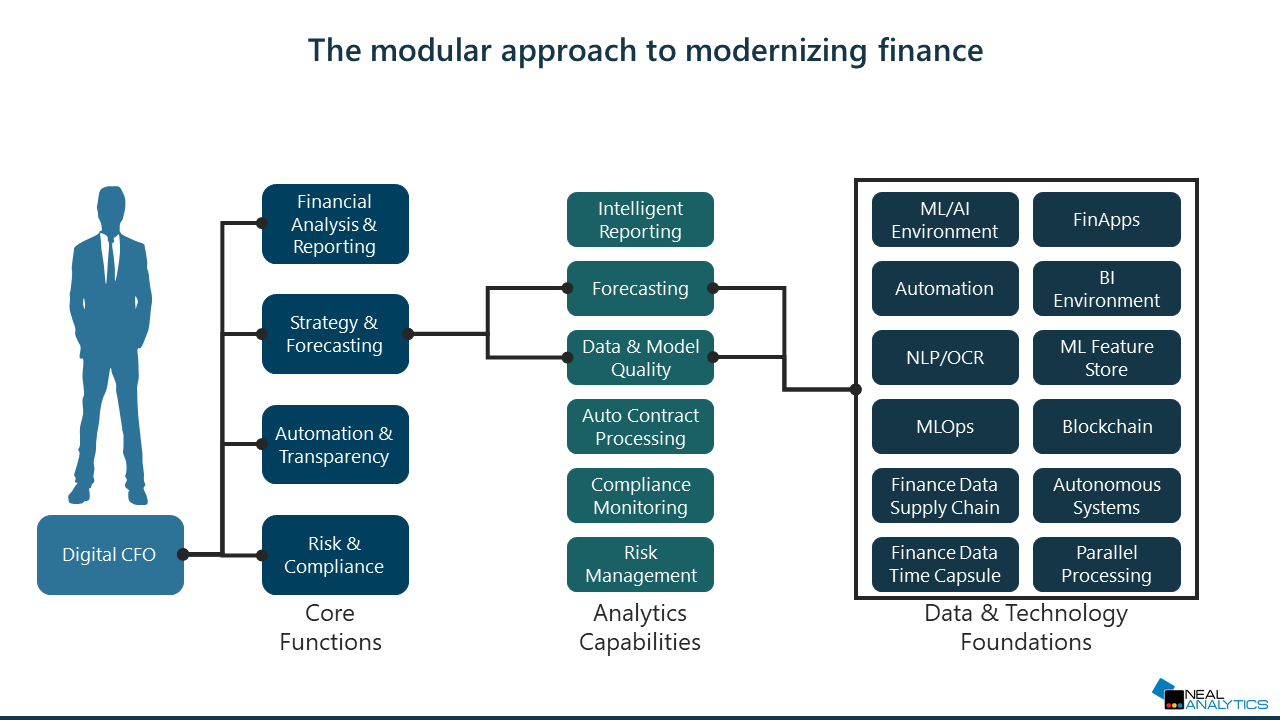

“Modern finance” refers to digital maturity in corporate finance. Modern finance teams typically leverage solutions built on a cloud-based data environment designed to help improve financial analysis & reporting, strategy & forecasting, regulatory compliance capabilities, and employee efficiency.

Benefits

Improve forecasting & planning accuracy

Ensure compliance

Enable greater efficiency

Strategy & forecasting

Modernizing finance data allows organizations to take advantage of cloud-native solutions that can help improve business strategy planning with more accurate financial forecasting.

By hosting financial data in a modern cloud environment, finance teams gain the ability to leverage all of the organization’s data and modern innovations like machine learning to create a more holistic understanding of the market. Gaining a better, more holistic view of finance data and market trends enables finance teams to create more accurate forecasts, allowing the organization to be more tactical in its strategy planning.

Financial analysis & reporting

Reporting and analyzing finance data is one of the most time-consuming tasks finance teams face regularly. By connecting disparate finance data sources to a central, cloud-based data environment for finance data, organizations can significantly simplify the process for reporting and analyzing data.

Instead of spending hours compiling financial data by hand and conducting analysis in siloes, organizations can automate the collection of financial data from the organization’s data sources. Compiling data in this fashion also allows easier data sharing, enabling sharing of existing analysis and dashboards, reducing time spent conducting redundant or duplicate analysis.

Risk & compliance

Modernizing finance can also help mitigate risk and ensure compliance with regulatory standards.

Rather than requiring compliance officers to manually review each business deal or contract for errors or irregularities, organizations can leverage solutions like natural language processing, which they can use to analyze documentation at scale. The analysis can check for errors ranging from typos and grammatical errors to incomplete or improperly filled forms. Solutions can even read written documents and parse them into searchable digital documents, which can help enhance auditing capabilities.

In addition to these capabilities, finance teams can implement templatized contracts for common business agreements. These contracts can be automatically filled based on a few initial inputs, greatly accelerating the contract creation and review process.

Business process automation

Automation is an area where finance teams can greatly improve team efficiency. Nearly 3 out of every 4 (72%) of finance teams spend 520 or more person-hours on tasks that could be automated with modern cloud solutions.

By leveraging business process automation in finance, organizations can drastically reduce time spent on tasks like invoicing, payment processing, and updating records to reflect new transaction data.

Why Neal?

Neal understands the complexity involved with modernizing financial data. Our modern finance solutions are designed to operate within finance-related compliance frameworks and can be tailored and customized to meet an organization’s unique needs and requirements.

Additionally, Neal Analytics offers a flexible engagement model that allows organizations to engage with Neal however works best for them. The flexible engagement model allows Neal experts to jump in and help regardless of where the organization is in their finance modernization journey.

Neal Analytics is an infrastructure, data & AI, and digital & app innovation Microsoft Solutions Partner that accelerates data-driven transformation initiatives for enterprises committed to the Microsoft cloud.

Interested in learning more about modern finance?